Compare funeral insurance

- You can save a lot of money when you choose to insure a funeral instead of saving for the expenses

- A Dutch funeral insurance can cover a farewell ceremony in your home country

- A funeral insurance can be easily arranged online in just a few minutes

The level of cover, premium and policy conditions differ considerably, depending on the insurance firm. This makes comparing the different insurance policies all the more important.

These are the things to consider when making a comparison between different insurance plans:

1. Type of insurance

Some insurance plans cover a pre-arranged ‘set package’ of funeral services. The insurance company will settle the bill directly with the undertaker. These are called ‘naturaverzekeringen’ and are usually a bit cheaper since the insurance company can make a standard, pre-fixed arrangement with the funeral director.

Other insurance policies are based on a ‘expenses only’ system, where the beneficiaries only get a pay-out for the expenses that are linked to the funeral itself. These are called ‘sommenverzekeringen’.

If you desire that your family can completely decide for themselves how they arrange the funeral, you may opt for a ‘kaptiaalverzekering’. This type of insurance will pay-out a set amount of money after the insured has passed away. This type of insurance will, for example, be suitable for paying for the funeral abroad, because the money can be used for any purpose.

A combination of the above insurance schemes is also possible. This is called a ‘combinatieverzekering’, which literally means combination policy.

2. Premium per month

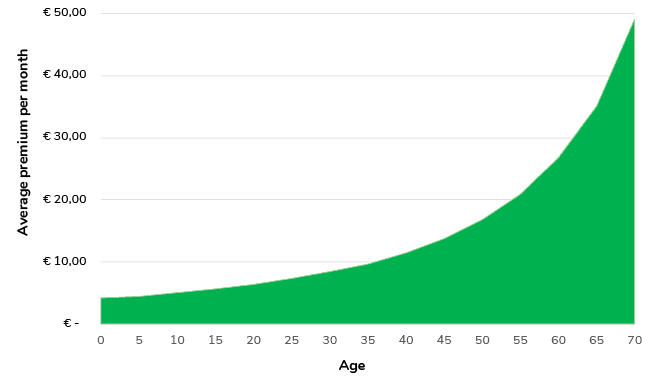

The monthly insurance premium will increase exponentially with age. Hence, it is far more profitable to apply for a funeral insurance early on. It is also easier to spread the costs over a longer period of time. The diagram below will show you why.

3. Premium payment period

The payment period indicates the total period you are obliged to pay a premium to the insurer. When comparing, it is wise to look at the total premium payment required. This can be done by multiplying the monthly premium by 12 and then times the remain years that are due for payment.

It will often be more profitable to pay a slightly higher premium in exchange for a shorter payment period.

4. Premium Indexation

Since the costs of a funeral increases every year, it may be wise to adjust the level of cover accordingly. This is done by indexing the insurance. Keep in mind that the monthly premium also goes up correspondingly. Ask the insurance company for more information.

5. Extra’s and conditions

With some insurance policies children are insured for free until they are 18 or 21. With other policies the insured amount may increase over time if the insurance companies makes profit with investments or corporate bonds. These kind of extra conditions are worthwhile to take into account when comparing.

Funeral cover abroad

Do you live in The Netherlands, but do you wish a funeral abroad? Then keep into account that extra costs may arise due to arrangements needed for travelling the body and having the service in another country. Therefore, it may be sensible to increase the level of cover accordingly. Perhaps even contact the insurer about the extra cover that is necessary.

Dutch insurance companies are very willing to help you and your loved ones organize a beautiful farewell ceremony in another country. Furthermore, the Dutch embassy can assist you in making the right choices and help you with the departure in The Netherlands.

Insurance companies

There are roughly 10 insurance firms in The Netherlands that offer funeral insurances. These are the main (and most affordable) ones:

| Insurance company | Policies offered |

|---|---|

| Yarden | Combinatie, kapitaal- en sommenverzekering |

| Monuta | Combinatie- en kapitaalverzekering |

| Dela | Combinatie- en kapitaalverzekering |

| Ardanta | Natura, kapitaal- en sommenverzekering |

| Nuvema | Natura- en combinatieverzekering |

| Klaverblad | Sommenverzekering |

Good to know (practical matters)

To conclude, we have an overview of practical matters that are good to know when arranging a funeral:

- A death must be reported to the municipality in which it occurred

- Cemeteries are usually open between 09:00 and 15:00 on weekdays and 09:00 to 12:00 on weekends and holidays.

- A burial or cremation is more expensive on Saturday, and even more on a Sunday or a national holiday (100 percent surcharge).

- If there is no money for the funeral, the municipality can pay for the costs.